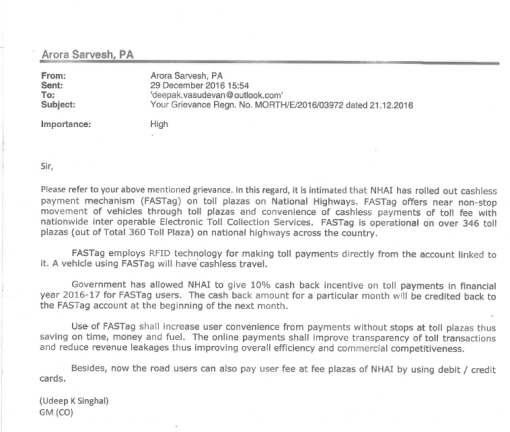

We forwarded the following suggestion to NHAI on 21st December 2016 vide CpGrams MORTH/E/2016/03975

Dear Team,

I was browsing through Automated Toll Collection and found out that ICICI is offering a service called FastTag which emits RFID at toll plazas and automatically pays the toll without the vehicle need to stop over.

I would like to recommend this to NHAI to give it more publicity and perhaps you can make it ad supported in order to remove the initial fee which will further incentive and make more people adopt it.

That way vehicles will go non-stop, toll plazas will become no-cash and payment will be all-automatic.

For the benefits mentioned in the previous paragraph, I would like to submit this suggestion.

Thanks and Regards,

Deepak Vasudevan

———————

The response that came today from the ministry is found attached.

Posted by Vasudevan Deepak Kumar under

Finance,

Security,

Social Concern

Leave a Comment

Whenever I get a telemarketing call from a bank they say ‘Based on your relationship status …’. At times we might be confused on what types of relationships we had/have. If it is US we can look up for a credit report and savings bank reports operated from third parties. However since CIBIL applies only to credit cards I just thought how about requesting each bank a relationship summary. I had mentioned that the summary should include all closed and active relationships hitherto. This would ensure that no PII has been inadvertently misused by telemarketers/DSA/TSA.

Request sent on 21st December 2016

Here is the status as of now:

- Indian Bank. Got a spreadsheet from the branch in 2 days after IndCustomerFirst desk reminded the branch after a day.

- ICICI Bank. Responded in three days with an excel sheet in the most recent email address they had on records.

- Axis Bank. Other than an auto-responder no response yet.

- HDFC Bank. Totally no response.

- Standard Chartered. Borrowed ‘Additional Working Days’ two times and waiting for response.

- Central Bank of India (After 10 Days)

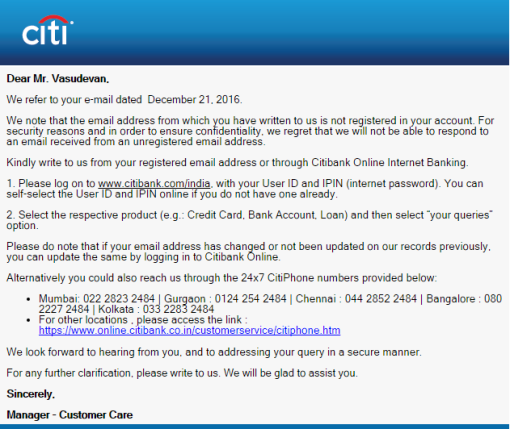

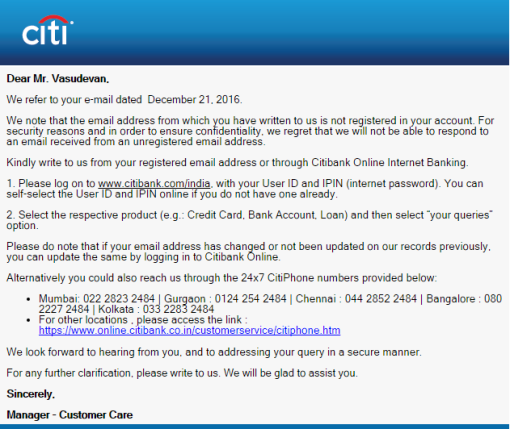

- Citibank. Borrowed ‘Additional Five Working Days’ today. And after a long delay of 12 days scribbled the below response on 2nd January 2017.

- IndusInd Bank. Totally no response.

Can this be taken as a measurement of transparency possessed by these banking organisations?

Posted by Vasudevan Deepak Kumar under Uncategorized

Leave a Comment

As a gesture of supporting Shri Narendra Modi’s venture against black money we sent out the following petition to PM Cell on 13th November 2016.

———————-

Dear Team,

Our Hon’ble PM has brought a best measure to weed out black money by abolishing 500/1000 rupee notes. However at least in Chennai the following are majorly thriving black money hubs.

- Merchants refusing cashless transactions by charging at least 3.5% over and above the bill price. They want everything in cash. And some merchants charge extra for giving receipt too.

- Builders force people to pay a percentage in cash and a percentage by cheque (some play here by asking to write a cheque to a different name too).

- Auto wallahs are another big source of black money mafia. The Government run complaints helpline is a catastrophic failure and autos continue to fleece passengers with their skyrocketing prices. And incidentally it is said that autos are owned by powerful people and hence a good collection of auto operational revenues reach them.

- IRCTC, Government run Bus Booking Services like APSRTC, KSRTC, TNSTC, Electricity Payment Services by TANGEDCO charge higher premium charges for cashless transactions which is a discouraging trend.

Can you kindly look into these too?

———————-

Response to this petition (PMOPG/E/2016/0449522) came on 6th December 2016 as below:

The issue raised in your grievance pertains to Policy matter. Your grievance has been forwarded to JS, TPL-I, RNO: 148-A, Ministry of Finance, Dept of Revenue, North Block, New Delhi -110001, Tel: 011-23092988, for further necessary action.